You can check 17+ pages chapter 14 accounting for uncollectible accounts receivable explanation in PDF format. Some of the questions that we will be dealing with in this chapter are at what point accounts receivable turn into bad debts or uncollectible accounts how and what to. This method violates the matching principle as the uncollectible account. Chapter 14 - Business Combination PFRS 3. Check also: accounting and chapter 14 accounting for uncollectible accounts receivable Revised summer 2016 chapter review accounting for accounts receivable key terms and concepts to know accounts receivable.

Accounting for Uncollectible Accounts Receivable. 9th - 12th grade.

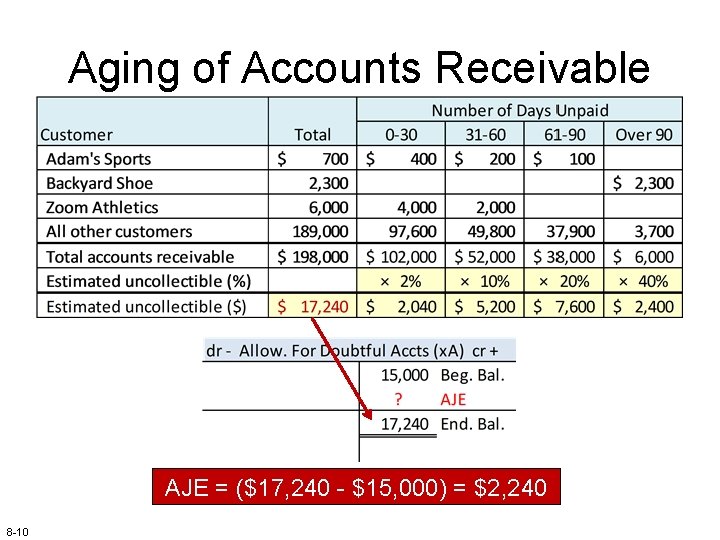

C H A P T E R 8 Accounts Receivables Ppt Video Online Download A business having a 40000 debit balance in Allowance for Uncollectible Accounts and estimating its uncollectible accounts using accounts receivable aging to be 500000 would record a 540000 credit to Allowance for Uncollectible Accounts.

| Topic: Accounting for Uncollectible Accounts Receivable DRAFT. C H A P T E R 8 Accounts Receivables Ppt Video Online Download Chapter 14 Accounting For Uncollectible Accounts Receivable |

| Content: Synopsis |

| File Format: PDF |

| File size: 2.2mb |

| Number of Pages: 7+ pages |

| Publication Date: July 2021 |

| Open C H A P T E R 8 Accounts Receivables Ppt Video Online Download |

|

Crediting the estimated value of uncollectible accounts to a contra account.

The difference between the balance of accounts receivable and its contra account allowance for uncollectible accounts. Companies use the percentage-of-receivables basis to apply the allowance method. 6Accounting for Receivables After studying this chapter you should be able to. Allowance For Uncollectible Accounts general journal entries. Start studying Chapter 14 accounting. This cookie is set by GDPR Cookie Consent plugin.

Account Receivables Accounts Receivable Three Accounting Issues 1 26CHAPTER 24 Uncollectible Accounts Receivable What Youll Learn Explain methods used to write off uncollectible accounts.

| Topic: ACCOUNTING FOR BAD DEBTS 615 Learning Objectives All companies Internet-based or not that sell goods or services on account will eventually have to face the problem of not being able to collect some of the money owed them. Account Receivables Accounts Receivable Three Accounting Issues 1 Chapter 14 Accounting For Uncollectible Accounts Receivable |

| Content: Answer Sheet |

| File Format: PDF |

| File size: 1.5mb |

| Number of Pages: 11+ pages |

| Publication Date: April 2020 |

| Open Account Receivables Accounts Receivable Three Accounting Issues 1 |

|

Accounting Cycle Powerpoint Presentation Slides Accounting Cycle Accounting Accounting Process 4 Download Free Chapter 8 Accounting For Receivables SolutionsThere are two methods of accounting for uncollectible accounts.

| Topic: The direct write-off method Metode Langsung of accounting for uncollectible receivables records bad debt expense only when an account is determined to be worthless. Accounting Cycle Powerpoint Presentation Slides Accounting Cycle Accounting Accounting Process Chapter 14 Accounting For Uncollectible Accounts Receivable |

| Content: Learning Guide |

| File Format: Google Sheet |

| File size: 1.8mb |

| Number of Pages: 25+ pages |

| Publication Date: June 2019 |

| Open Accounting Cycle Powerpoint Presentation Slides Accounting Cycle Accounting Accounting Process |

|

Account Receivables Accounts Receivable Three Accounting Issues 1 A simple method to account for uncollectible accounts is the direct write-off approach.

| Topic: 20LO 2LO 2 Uncollectible Receivables Piutang Tak tertagih past due. Account Receivables Accounts Receivable Three Accounting Issues 1 Chapter 14 Accounting For Uncollectible Accounts Receivable |

| Content: Summary |

| File Format: Google Sheet |

| File size: 3.4mb |

| Number of Pages: 26+ pages |

| Publication Date: September 2020 |

| Open Account Receivables Accounts Receivable Three Accounting Issues 1 |

|

Chapter 9 Lecture Accounting For Receivables Part 1 Start studying chapter 14 vocab accounting.

| Topic: Describe the entries to record the disposition of accounts receivable. Chapter 9 Lecture Accounting For Receivables Part 1 Chapter 14 Accounting For Uncollectible Accounts Receivable |

| Content: Solution |

| File Format: PDF |

| File size: 1.4mb |

| Number of Pages: 17+ pages |

| Publication Date: June 2019 |

| Open Chapter 9 Lecture Accounting For Receivables Part 1 |

|

Smf8xmpkgbc 0m Accounting for Uncollectible Accounts Receivable DRAFT.

| Topic: 19Chapter 14 Study Guide Accounting 2. Smf8xmpkgbc 0m Chapter 14 Accounting For Uncollectible Accounts Receivable |

| Content: Analysis |

| File Format: DOC |

| File size: 1.5mb |

| Number of Pages: 30+ pages |

| Publication Date: February 2021 |

| Open Smf8xmpkgbc 0m |

|

Learncbse Ncert Solutions On Ncert Solutions Solutions Class Chapter Explain how accounts receivable are recognized in the accounts.

| Topic: 4 Download Ebook Journal Entry For Uncollectible Accounts ReceivableCredits Irrecoverable u0026 Doubtful Debts Accounting - Accounts Receivables and Bad Debts - Severson Bad Debts Allowance Method Direct Write Off Full course FREE in description Ch. Learncbse Ncert Solutions On Ncert Solutions Solutions Class Chapter Chapter 14 Accounting For Uncollectible Accounts Receivable |

| Content: Synopsis |

| File Format: DOC |

| File size: 1.9mb |

| Number of Pages: 28+ pages |

| Publication Date: March 2017 |

| Open Learncbse Ncert Solutions On Ncert Solutions Solutions Class Chapter |

|

5 Ways To Efficiently Manage Your Accounts Receivables Biz2credit In Accounts Receivable Accounting Financial Health Under this technique a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible.

| Topic: Allowance for Loss on Accounts Receivable represents the estimated amount of uncollectible accounts receivable from the public so that receivables can be reported at their net realizable value ie net an estimate of receivables reasonably likely to become uncollectible. 5 Ways To Efficiently Manage Your Accounts Receivables Biz2credit In Accounts Receivable Accounting Financial Health Chapter 14 Accounting For Uncollectible Accounts Receivable |

| Content: Synopsis |

| File Format: DOC |

| File size: 3mb |

| Number of Pages: 22+ pages |

| Publication Date: November 2021 |

| Open 5 Ways To Efficiently Manage Your Accounts Receivables Biz2credit In Accounts Receivable Accounting Financial Health |

|

How To Read Financial Statements Of A Pany Financial Statement Financial Statement Analysis Money Management Advice This cookie is set by GDPR Cookie Consent plugin.

| Topic: Start studying Chapter 14 accounting. How To Read Financial Statements Of A Pany Financial Statement Financial Statement Analysis Money Management Advice Chapter 14 Accounting For Uncollectible Accounts Receivable |

| Content: Synopsis |

| File Format: Google Sheet |

| File size: 2.3mb |

| Number of Pages: 10+ pages |

| Publication Date: August 2020 |

| Open How To Read Financial Statements Of A Pany Financial Statement Financial Statement Analysis Money Management Advice |

|

Acc205 Acc 205 Week 4 Dq 2 Receivables Ethical Issues Accounting Cycle Managerial Accounting The difference between the balance of accounts receivable and its contra account allowance for uncollectible accounts.

| Topic: Acc205 Acc 205 Week 4 Dq 2 Receivables Ethical Issues Accounting Cycle Managerial Accounting Chapter 14 Accounting For Uncollectible Accounts Receivable |

| Content: Learning Guide |

| File Format: PDF |

| File size: 810kb |

| Number of Pages: 17+ pages |

| Publication Date: October 2021 |

| Open Acc205 Acc 205 Week 4 Dq 2 Receivables Ethical Issues Accounting Cycle Managerial Accounting |

|

Account Receivables Accounts Receivable Three Accounting Issues 1

| Topic: Account Receivables Accounts Receivable Three Accounting Issues 1 Chapter 14 Accounting For Uncollectible Accounts Receivable |

| Content: Summary |

| File Format: DOC |

| File size: 1.4mb |

| Number of Pages: 40+ pages |

| Publication Date: April 2020 |

| Open Account Receivables Accounts Receivable Three Accounting Issues 1 |

|

Sap Fi Accounts Receivable Table Of Contents Ar

| Topic: Sap Fi Accounts Receivable Table Of Contents Ar Chapter 14 Accounting For Uncollectible Accounts Receivable |

| Content: Synopsis |

| File Format: Google Sheet |

| File size: 1.8mb |

| Number of Pages: 15+ pages |

| Publication Date: September 2020 |

| Open Sap Fi Accounts Receivable Table Of Contents Ar |

|

Its really simple to prepare for chapter 14 accounting for uncollectible accounts receivable Chapter 9 lecture accounting for receivables part 1 account receivables accounts receivable three accounting issues 1 sap fi accounts receivable table of contents ar 5 ways to efficiently manage your accounts receivables biz2credit in accounts receivable accounting financial health learncbse ncert solutions on ncert solutions solutions class chapter sap fi accounts receivable table of contents ar how to read financial statements of a pany financial statement financial statement analysis money management advice accounting cycle powerpoint presentation slides accounting cycle accounting accounting process

0 Comments